The current high interest rate environment has prompted seismic shifts in the financial world. This is especially true in the realm of industrial real estate where the reassessment of cap rates and property value is not just a topic for debate but an exploration of new lucrative horizons. This article will navigate the opportunities and challenges that await amidst the existing economic tides.

Cap Rates and Their Connection to Interest Rates

Cap rates are a common metric used in the commercial real estate industry to help evaluate and compare similar properties. They show how much money an asset might make each year compared to its price. Think of it like this: if a property has a high cap rate it means you could earn more from it each year. But it also usually means the asset’s price tag is lower.

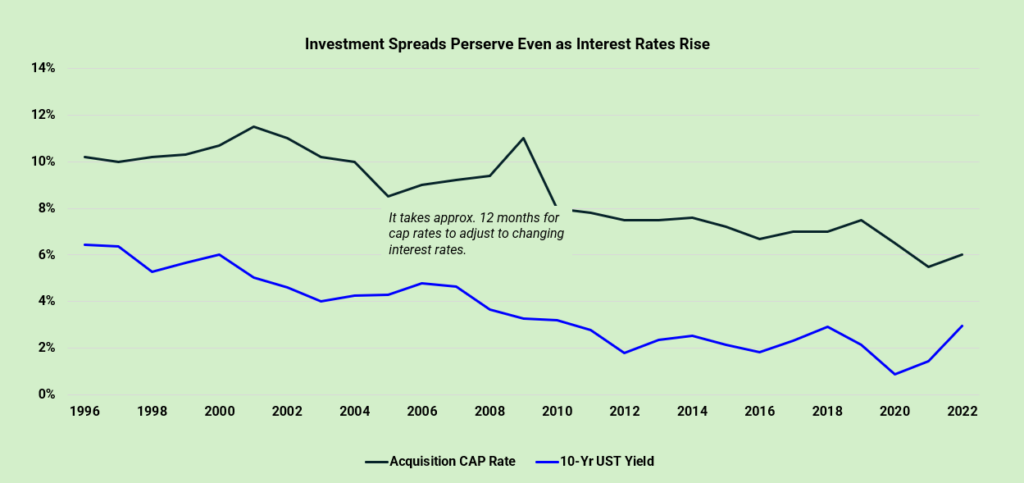

Now, when interest rates go up, things get interesting. Higher interest rates make safe investments like treasury bonds more attractive because they offer better returns without much risk. So, for real estate to keep investors interested, it must promise even more earnings. This is why cap rates start to climb. A higher cap rate means the property’s future earnings don’t look as valuable as they did before, leading to a drop in how much it is worth.

Experts in the field tell us that when interest rates tick up, cap rates follow. They’ve noticed that for every big jump in interest rates, cap rates tend to follow suit with an approximately 12-month lag.

Bullish Long-Term Outlook for Industrial Real Estate

Despite short-term headwinds caused by high interest rates, the industrial real estate sector stands on a solid macroeconomic foundation. Urban expansion coupled with economic growth has catapulted the demand for manufacturing hubs, warehouses, and distribution centers, especially those nestled close to city centers. The sector’s resilience is strengthened by long-term leases that give it the ability to withstand economic ebbs and flows. Adding the current trends of nearshoring and the complexities of global supply chains (please read “Global Manufacturing Shifts Boost Mexico’s Industrial Market”), you have a recipe for enduring growth at strategic locations.

Opportunities Amidst Rising Interest Rates

Current market dynamics, while challenging, will unveil golden opportunities for proactive investors. Now is the time for strategic acquisitions to unlock value in anticipation of a future decrease in interest rates and a subsequent rise in industrial asset prices.

For those eyeing industrial real estate in these high-interest times, prioritizing strategic locations, investment-grade tenants and robust class-A assets is key. Here at Daoment, we champion thorough market, tenant, and property due diligence, coupled with a clear and forward-looking investment approach that aligns with long-term market trends and growth opportunities.

Conclusion

The juxtaposition of short-term challenges and long-term opportunities defines the current high interest rate environment’s impact on the industrial real estate industry. While the immediate landscape has significant hurdles, the sector’s core strengths and the prevailing macroeconomic winds signal a promising future for those willing to engage.